Poland's EV charging market report

Leveraging over a decade of expertise in location-based intelligence and predictive modeling, we have developed a comprehensive report on the Polish market for public electric vehicle charging, based on the curated data from the ChargePlanner platform.

Executive summary

Poland’s EV market is picking up speed. By 2030, the number of electric vehicles is expected to grow tenfold. But the public charging network isn’t ready yet. Only 15.6 % of the required capacity is in place, and some regions, especially in the east, are far behind.

At the same time, the cost of connecting to the grid has doubled and processes to apply for new connections are slow.

Key insights of the Polish EV charging infrastructure:

- Poland’s EV fleet is set to grow from 115 K vehicles to around 1 900 K by 2030

- Strong charging infrastructure growth is needed: Public charging capacity stands at 318 MW: far below the 2 040 GW needed within five years

- The CPO market is concentrated: Greenway, Powerdot, and Elocity control 55 % of total offered capacity

- Charging prices vary significantly: from 1.60 zł/kWh to 2.58 zł/kWh for (ultra)fast charging, and 1.23 zł/kWh to 2.30 zł/kWh for slow charging

- Grid connection fees doubled in January 2024, from 30 PLN/kW to 60 PLN/kW, making careful location planning more critical than ever

The message is clear: it’s more than ever important to take smarter EV charging infrastructure decisions.

Table of Contents

EV charging market overview Poland vs Europe

In the table below we compare EV adoption and charging infrastructure per type of charger for 10 different European countries, including pricing. This way, you can easily benchmark the Polish market with other neighboring countries.

With around 150 K electric vehicles for a population of over 36 million, Poland lags behind most of its European neighbours in terms of penetration.

Today, Poland has more than 3.5 K (ultra)fast charging points and nearly 7 K slow charging public charging points. That’s a high ratio of chargers to EVs, meaning usage rates per charging point are still relatively low, but this also suggests that infrastructure is being built ahead of demand.

Many CPOs are developing Poland early, anticipating a sharp rise in EV ownership (towards nearly 2M EVs), and preparing for eHDV to start using the car charging infrastructure.

Fast chargers (50–149 kW) make up the bulk of installations, outnumbering ultrafast chargers (150+ kW) by about four to one. That imbalance may reflect the challenges the sector faces: grid limitations, lengthy processes, high electricity costs, all making high-capacity installations more difficult.

In terms of price, Poland falls in the mid-to-high range: generally cheaper than Germany but more expensive than France or Spain.

The prices shown are excluding VAT.

These numbers were reported on 01/01/2025. For the latest numbers, visit https://chargeplanner.retailsonar.com/blog/ev-charging-infrastructure-europe

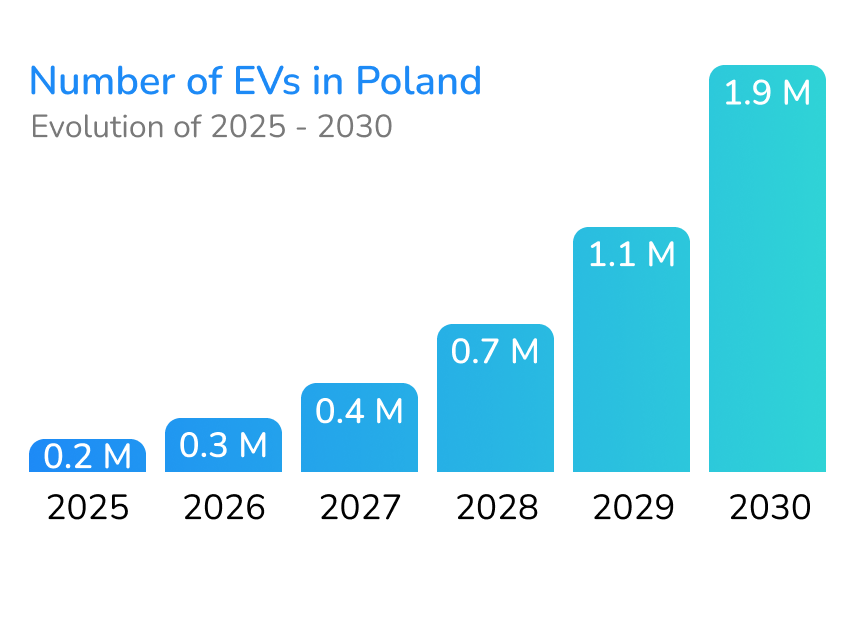

Evolution of EV adoption in Poland until 2030

The number of EVs on the road is set to grow tenfold by the end of 2030.

Poland’s EV fleet is expected to grow 10x from around 115 K EVs today to nearly 1 900 K by 2030. That includes both battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), with BEVs projected to dominate.

This kind of growth will put huge pressure on the charging infrastructure. To keep up, the country will need to increase its public charging capacity from 318 MW today to over 2 040 MW by 2030, a massive gap to close in a short time.

What is the EV charging capacity per brand in Poland?

3 brands account for 55 % of installed EV charging capacity

The charge point operator (CPO) market is still relatively small, but already dominated by three key players in Poland:

- Greenway

- Powerdot

- Elocity

Polish EV competitive benchmarking

Big similarities but different positioning

Despite similar capacity, each of these CPOs has positioned itself differently in the market:

- Greenway focuses its location planning on the (ultra)fast segment

- Elocity has built out a strong position in the AC (slow charging) market

- Powerdot is more balanced with a higher average power for its ultrafast chargers

Wide pricing spread among CPOs

There’s a noticeable spread in pricing across charge point operators in Poland, both for (ultra)fast and slow charging.

- (Ultra)fast charging ranges from 1.60 zł/kWh (Tesla Supercharger) to 2.85 zł/kWh (ORLEN). That’s a 78 % price difference between the cheapest and most expensive offers.

- Slow charging varies from 1.23 zł/kWh (Polenergia eMobility) to 2.30 zł/kWh (PowerDot), nearly a twofold difference.

As price sensitivity is increasing, it is important that CPOs think with care about their pricing strategies. There are multiple factors that could influence how smart location decisions drive higher margins for CPOs.

| Total Capacity | Charging Points | Ultrafast Charging Points | Avg. Power Ultrafast (kW) | Fast Charging Points | Avg. Power Fast (kW) | Slow Charging Points | Avg. Power Slow (kW) | Price/kW Ultrafast (€) | Price/kW Slow (€) | |

|---|---|---|---|---|---|---|---|---|---|---|

| EnBW | 955 MW | 10.428 | 6.47 | 206 | 617 | 50 | 3.341 | 24 | 0,73 | 0,59 |

| Tesla Supercharger | 472 MW | 3.211 | 3.211 | 245 | ||||||

| Aral Pulse | 447 MW | 3.343 | 2.386 | 252 | 948 | 100 | 9 | 22 | 0,66 | |

| IONITY | 218 MW | 1.089 | 1.089 | 340 | 0,58 | |||||

| Shell Recharge | 217 MW | 2.509 | 1.286 | 261 | 48 | 120 | 1.175 | 6 | 0,66 | |

| EWE Go | 212 MW | 2.689 | 1.493 | 205 | 167 | 58 | 1.029 | 22 | 0,44 | 0,44 |

| Allego | 182 MW | 2.055 | 1.284 | 188 | 356 | 55 | 415 | 28 | 0,61 | 0,49 |

| ChargePoint | 167 MW | 8.907 | 414 | 202 | 194 | 58 | 8.299 | 22 | 0,63 | 0,48 |

| Pfalzwerke | 149 MW | 1.883 | 993 | 216 | 206 | 54 | 684 | 20 | ||

| no operator name | 136 MW | 6.528 | 379 | 235 | 335 | 63 | 5.814 | 20 | ||

| Compleo | 120 MW | 7.864 | 133 | 258 | 107 | 72 | 7.624 | 21 | ||

| Citywatt GmbH | 94 MW | 1.116 | 478 | 289 | 27 | 52 | 611 | 22 | 0,79 | 0,54 |

| E.ON Drive | 75 MW | 3.197 | 270 | 208 | 507 | 56 | 2.42 | 18 | 0,60 | 0,49 |

| Mer Germany | 72 MW | 1.777 | 329 | 217 | 280 | 56 | 1.168 | 23 | ||

| Volkswagen Group | 70 MW | 5.6 | 106 | 198 | 176 | 53 | 5.318 | 17 | 0,70 | |

| reev | 61 MW | 4.309 | 28 | 239 | 90 | 56 | 4.191 | 21 | ||

| TEAG Mobil | 58 MW | 874.0 | 410 | 195 | 55 | 55 | 409 | 23 | 0,66 | 0,51 |

| ALDI SÜD | 55 MW | 1.612 | 373 | 150 | 210 | 58 | 1.029 | 23 | 0,33 | 0,24 |

| Comfortcharge | 48 MW | 1.195 | 422 | 152 | 156 | 53 | 617 | 12 | ||

| Lidl | 46 MW | 1.856 | 10 | 350 | 986 | 54 | 860 | 23 | ||

| Fastned | 45 MW | 255.0 | 231 | 311 | 24 | 50 | 0,58 | |||

| Vattenfall InCharge | 44 MW | 1.322 | 268 | 194 | 35 | 92 | 1.019 | 14 | ||

| EDEKA | 40 MW | 1.923 | 46 | 150 | 679 | 54 | 1.198 | 21 | ||

| Hamburger Energiewerke Mobil | 39 MW | 2.039 | 145 | 155 | 29 | 50 | 1.865 | 22 | 0,60 | 0,42 |

| GP Joule Connect GmbH | 37 MW | 786.0 | 173 | 268 | 51 | 79 | 562 | 20 | 0,76 | 0,56 |

| Porsche | 37 MW | 220.0 | 171 | 351 | 49 | 21 | ||||

| MENNEKES | 31 MW | 2.403 | 2.403 | 22 | 0,37 | |||||

| Wirelane | 31 MW | 2.847 | 11 | 50 | 2.836 | 19 | ||||

| JOLT Energy | 30 MW | 162.0 | 162 | 314 | 0,40 | |||||

| MVV Energie | 30 MW | 880.0 | 117 | 264 | 56 | 50 | 707 | 21 | ||

| Kaufland | 30 MW | 1.13 | 8 | 217 | 726 | 54 | 396 | 23 | 0,46 | 0,40 |

| ChargeIT mobility | 30 MW | 1.663 | 61 | 191 | 79 | 63 | 1.523 | 22 | ||

| Energie Südbayern (ESB) | 29 MW | 1.082 | 108 | 183 | 69 | 55 | 905 | 22 | ||

| TankE | 28 MW | 1.702 | 30 | 196 | 106 | 73 | 1.566 | 22 | ||

| TotalEnergies | 26 MW | 1.616 | 21 | 169 | 164 | 60 | 1.431 | 20 | 0,61 | 0,53 |

| Other brands | 1329 MW | 71.479 | 3.321 | 210 | 2.94 | 58 | 65.218 | 21 | 0,64 | 0,54 |

| Grand total | 5688 MW | 163.551 | 26.426 | 210 | 10.434 | 58 | 126.691 | 21 | 0,64 | 0,54 |

| Brand | Total capacity | Number of charging points |

Ultrafast | Fast | Slow | Price per kW (€) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| # Charging points |

Average power (kW) |

# Charging points |

Average power (kW) |

# Charging points |

Average power (kW) |

(Ultra)fast | Slow | |||

| GreenWay | 77 MW | 1 844 | 182 | 174 | 742 | 102 | 920 | 22 | ||

| Elocity | 49 MW | 2 546 | 72 | 167 | 518 | 62 | 2 | 20 | 1.80 | 1.53 |

| PowerDot | 49 MW | 1 160 | 50 | 195 | 730 | 89 | 380 | 17 | 2.28 | 1.84 |

| ORLEN | 23 MW | 991 | 6 | 180 | 263 | 64 | 722 | 29 | ||

| IONITY | 16 MW | 76 | 76 | 350 | 2.85 | |||||

| Tesla Supercharger | 13 MW | 104 | 104 | 193 | ||||||

| Polenergia eMobility | 11 MW | 119 | 58 | 230 | 24 | 106 | 37 | 13 | 1.60 | 1.30 |

| eTAURON | 8 MW | 509 | 1 | 150 | 83 | 55 | 425 | 22 | 1.62 | 1.23 |

| Eleport | 8 MW | 466 | 12 | 150 | 20 | 58 | 434 | 22 | 2.02 | 1.45 |

| Ekoen | 7 MW | 69 | 41 | 228 | 13 | 78 | 15 | 24 | ||

| Lidl | 6 MW | 265 | 1 | 180 | 120 | 52 | 144 | 22 | ||

| Kaufland | 6 MW | 204 | 132 | 58 | 72 | 25 | 1.91 | 1.67 | ||

| EQUAY | 5 MW | 283 | 11 | 182 | 21 | 59 | 251 | 21 | 2.09 | 1.90 |

| HoryzontEV | 4 MW | 148 | 23 | 155 | 10 | 76 | 115 | 22 | 1.90 | 1.32 |

| EV Plus | 4 MW | 267 | 2 | 150 | 16 | 66 | 249 | 20 | ||

| Energa | 3 MW | 158 | 2 | 180 | 20 | 50 | 136 | 22 | ||

| Arinea | 3 MW | 122 | 2 | 150 | 29 | 64 | 91 | 24 | 2.58 | 2.30 |

| Shell Recharge | 2 MW | 24 | 8 | 190 | 16 | 117 | 2.44 | |||

| Other brands | 25 MW | 1 191 | 45 | 224 | 154 | 74 | 992 | 21 | 2.24 | 1.62 |

| Grand total | 318 MW | 10 546 | 696 | 202 | 2 911 | 73 | 6 939 | 21 | 2.16 | 1.62 |

The prices shown are excluding VAT.

Future charging needs per region in Poland

Poland is only at 15.6 % of the public charging capacity it needs by 2030.

This is very low compared to other countries and is due to the massive expected growth of EVs. The good news is, municipalities are beginning to release public tenders to accelerate deployment and the EU’s AFIR targets are pushing national and regional players to move faster.

However, the potential differs between regions.

Uneven growth, eastern regions are still behind.

Western and southern regions (e.g. Lubuskie, Opolskie) are relatively well-developed with 35% and 28% of current capacity vs the 2030 target.

But eastern regions (e.g. Podladskie, Lubelskie and Świętokrzyskie) are severely underserved with 9% of the needed capacity by 2030.

It’s clear that there is immense potential in Poland to develop the right EV charging infrastructure, but it’s important to develop it smartly. This is shown in this EV charging hotspot in Gdansk, Pomeranian.

Detailed overview of charging needs per region in Poland

| Zone (Voivodeship) |

Public charging power available in 2025 |

Public charging power needs 2030 |

Public charging power to develop by 2030 |

% public charging power available vs 2030 targets |

|---|---|---|---|---|

| Greater Poland | 32 MW | 178 MW | 146 MW | 18% |

| Kuyavian-Pomeranian | 17 MW | 104 MW | 87 MW | 16% |

| Lesser Poland | 23 MW | 178 MW | 155 MW | 13% |

| Lodz | 24 MW | 125 MW | 101 MW | 19% |

| Lower Silesia | 25 MW | 160 MW | 135 MW | 16% |

| Lublin | 9 MW | 97 MW | 88 MW | 9% |

| Lubusz | 16 MW | 46 MW | 30 MW | 35% |

| Masovian | 50 MW | 421 MW | 372 MW | 12% |

| Opole | 10 MW | 36 MW | 26 MW | 28% |

| Podlaskie | 5 MW | 59 MW | 53 MW | 9% |

| Pomeranian | 18 MW | 128 MW | 110 MW | 14% |

| Silesian | 41 MW | 218 MW | 177 MW | 19% |

| Subcarpathian | 11 MW | 86 MW | 75 MW | 13% |

| Swietokrzyskie | 4 MW | 49 MW | 45 MW | 9% |

| Warmian-Masurian | 11 MW | 67 MW | 56 MW | 16% |

| West Pomeranian | 22 MW | 88 MW | 65 MW | 26% |

| Total | 318 MW | 2 040 MW | 1 722 MW | 16% |

How can you create your most profitable network by 2030?

In the sprint towards the 2030 targets, making smart, data-driven location decisions is more critical than ever. Acting quickly is essential, but acting strategically is what drives real returns. True ROI comes from placing the right type and number of charging points at locations where connection costs are viable and demand is proven.

To do this effectively, you need clear insights into the factors that define the performance of EV charging stations: from car passage and dwell time to local activity and infrastructure access. But gathering, combining, and analyzing all that data? That’s a challenge.

That's where ChargePlanner comes in. The platform lets you simulate and test multiple configurations at once, combining best-in-class market data, local visitor behavior, and predictive AI.