Germany's EV charging market report

Leveraging over a decade of expertise in location-based intelligence and predictive modeling, we have developed a comprehensive report on the German market for public electric vehicle charging, based on the curated data from the ChargePlanner platform.

Executive summary

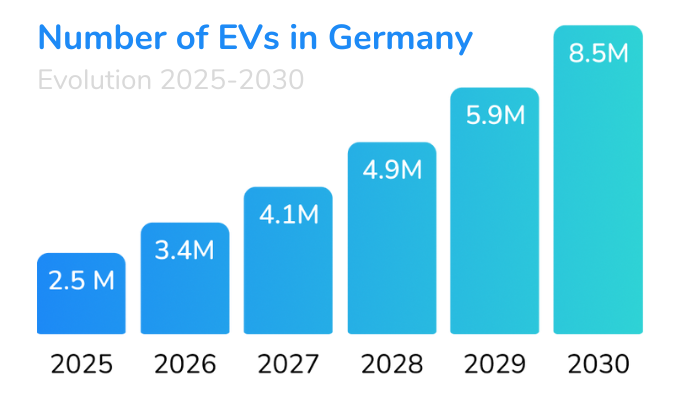

In this report we guide you through a market analysis of the German EV market. Today, over 2.5 million electric vehicles are on German roads. In the coming years exponential growth is expected towards 8.5 million EVs in 2030.

To support this growth, Germany must scale their public charging capacity from 5.7 GW today to 9.3 GW by 2030. Mainly public AC charging infrastructure is missing today. In particular, in regions such as Berlin, Bremen and Hamburg are lagging behind in the development of public chargers. These dense-urban areas are precisely the areas where private charging options are limited, and public infrastructure will play the biggest role.

Next to infrastructure, Germany displays some of the highest public charging prices in Europe, largely due to steep electricity costs. If not addressed, this could slow the switch from fossil fuel to electric, especially for price-sensitive drivers. Below, you can find a key cross-country data comparison on market size, share, split and pricing.

Table of Contents

EV charging market overview Germany vs Europe

In the table below we show current market penetration of EVs and current EV charging infrastructure insights per type of charger for 10 different European countries, including pricing. In this way you can easily benchmark the German market with other neighboring countries.

With EV penetration currently at 4%, Germany finds itself in the middle of the European peloton. Its public charging infrastructure mirrors this status: average overall capacity, with more than enough DC charging points to fulfill the current needs. However, AC charging points are underrepresented today with more than 27 EVs per public AC charging point.

When it comes to public charging prices, Germany is the one of the most expensive country in the list. CPOs ask on average even 40% to 50% higher prices than their French counterparts.

The prices shown are excluding VAT.

These numbers were reported on 01/01/2025. For the latest numbers, visit https://chargeplanner.retailsonar.com/blog/ev-charging-infrastructure-europe

Evolution of EV adoption in Germany until 2030

The number of EVs on the road is set to triple by the end of 2030.

In 2024, Germany had 2.5 million EVs on the road. This number includes both battery electric and plug-in hybrid electric vehicles. That number is set to more than triple to 8.5 million by 2030. This also means that by 2030 Germany should foresee a minimum capacity of about 9.3 GW for public charging. Today 5.7 GW of capacity is already installed in the country.

What is the EV charging capacity per brand?

There are 8 brands that dominate the EV charging station market.

Currently 5.7GW of available capacity is distributed over the different competitors in the German market. The graph below shows the 8 most dominant players in the German market today:

- EnBW

- Tesla

- Aral Pulse

- Ionity

- Shell Recharge

- EWE Go

- Allego

- ChargePoint

.png)

German EV charging competitive benchmarking

Offered capacity vs charging points

Generally, there's a positive correlation between a brand's total capacity and the number of charging points it offers. However, some brands like Tesla and Ewe Go service a specific side of the market (Tesla: Ultrafast, Ewe Go: Slow)

Varying pricing between charging stations suppliers

Some brands offer substantially higher prices for (ultra)fast charging than competitors. Cheapest prices can be found at retail sites such as Aldi and Kaufland. Of course these retailers that also exploit their own EV sites have integrated their e-mobility strategy in their broader strategy to attract customers to their stores. As price sensitivity is increasing, it is important that CPOs think with care about their pricing strategies. There are multiple factors that could influence how smart location decisions drive higher margins for CPOs.

See the full comparison table here.

| Total Capacity | Charging Points | Ultrafast Charging Points | Avg. Power Ultrafast (kW) | Fast Charging Points | Avg. Power Fast (kW) | Slow Charging Points | Avg. Power Slow (kW) | Price/kW Ultrafast (€) | Price/kW Slow (€) | |

|---|---|---|---|---|---|---|---|---|---|---|

| EnBW | 955 MW | 10.428 | 6.47 | 206 | 617 | 50 | 3.341 | 24 | 0,73 | 0,59 |

| Tesla Supercharger | 472 MW | 3.211 | 3.211 | 245 | ||||||

| Aral Pulse | 447 MW | 3.343 | 2.386 | 252 | 948 | 100 | 9 | 22 | 0,66 | |

| IONITY | 218 MW | 1.089 | 1.089 | 340 | 0,58 | |||||

| Shell Recharge | 217 MW | 2.509 | 1.286 | 261 | 48 | 120 | 1.175 | 6 | 0,66 | |

| EWE Go | 212 MW | 2.689 | 1.493 | 205 | 167 | 58 | 1.029 | 22 | 0,44 | 0,44 |

| Allego | 182 MW | 2.055 | 1.284 | 188 | 356 | 55 | 415 | 28 | 0,61 | 0,49 |

| ChargePoint | 167 MW | 8.907 | 414 | 202 | 194 | 58 | 8.299 | 22 | 0,63 | 0,48 |

| Pfalzwerke | 149 MW | 1.883 | 993 | 216 | 206 | 54 | 684 | 20 | ||

| no operator name | 136 MW | 6.528 | 379 | 235 | 335 | 63 | 5.814 | 20 | ||

| Compleo | 120 MW | 7.864 | 133 | 258 | 107 | 72 | 7.624 | 21 | ||

| Citywatt GmbH | 94 MW | 1.116 | 478 | 289 | 27 | 52 | 611 | 22 | 0,79 | 0,54 |

| E.ON Drive | 75 MW | 3.197 | 270 | 208 | 507 | 56 | 2.42 | 18 | 0,60 | 0,49 |

| Mer Germany | 72 MW | 1.777 | 329 | 217 | 280 | 56 | 1.168 | 23 | ||

| Volkswagen Group | 70 MW | 5.6 | 106 | 198 | 176 | 53 | 5.318 | 17 | 0,70 | |

| reev | 61 MW | 4.309 | 28 | 239 | 90 | 56 | 4.191 | 21 | ||

| TEAG Mobil | 58 MW | 874.0 | 410 | 195 | 55 | 55 | 409 | 23 | 0,66 | 0,51 |

| ALDI SÜD | 55 MW | 1.612 | 373 | 150 | 210 | 58 | 1.029 | 23 | 0,33 | 0,24 |

| Comfortcharge | 48 MW | 1.195 | 422 | 152 | 156 | 53 | 617 | 12 | ||

| Lidl | 46 MW | 1.856 | 10 | 350 | 986 | 54 | 860 | 23 | ||

| Fastned | 45 MW | 255.0 | 231 | 311 | 24 | 50 | 0,58 | |||

| Vattenfall InCharge | 44 MW | 1.322 | 268 | 194 | 35 | 92 | 1.019 | 14 | ||

| EDEKA | 40 MW | 1.923 | 46 | 150 | 679 | 54 | 1.198 | 21 | ||

| Hamburger Energiewerke Mobil | 39 MW | 2.039 | 145 | 155 | 29 | 50 | 1.865 | 22 | 0,60 | 0,42 |

| GP Joule Connect GmbH | 37 MW | 786.0 | 173 | 268 | 51 | 79 | 562 | 20 | 0,76 | 0,56 |

| Porsche | 37 MW | 220.0 | 171 | 351 | 49 | 21 | ||||

| MENNEKES | 31 MW | 2.403 | 2.403 | 22 | 0,37 | |||||

| Wirelane | 31 MW | 2.847 | 11 | 50 | 2.836 | 19 | ||||

| JOLT Energy | 30 MW | 162.0 | 162 | 314 | 0,40 | |||||

| MVV Energie | 30 MW | 880.0 | 117 | 264 | 56 | 50 | 707 | 21 | ||

| Kaufland | 30 MW | 1.13 | 8 | 217 | 726 | 54 | 396 | 23 | 0,46 | 0,40 |

| ChargeIT mobility | 30 MW | 1.663 | 61 | 191 | 79 | 63 | 1.523 | 22 | ||

| Energie Südbayern (ESB) | 29 MW | 1.082 | 108 | 183 | 69 | 55 | 905 | 22 | ||

| TankE | 28 MW | 1.702 | 30 | 196 | 106 | 73 | 1.566 | 22 | ||

| TotalEnergies | 26 MW | 1.616 | 21 | 169 | 164 | 60 | 1.431 | 20 | 0,61 | 0,53 |

| Other brands | 1329 MW | 71.479 | 3.321 | 210 | 2.94 | 58 | 65.218 | 21 | 0,64 | 0,54 |

| Grand total | 5688 MW | 163.551 | 26.426 | 210 | 10.434 | 58 | 126.691 | 21 | 0,64 | 0,54 |

| Brand | Total capacity | Number charging points |

Ultrafast | Fast | Slow | Price per kW (€) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| # Charging points |

Average power (kW) |

# Charging points |

Average power (kW) |

# Charging points |

Average power (kW) |

(Ultra)fast | Slow | |||

| EnBW | 955 MW | 10 428 | 6 470 | 206 | 617 | 50 | 3 341 | 24 | 0.73 | 0.59 |

| Tesla Supercharger | 472 MW | 3 211 | 3 211 | 245 | ||||||

| Aral Pulse | 447 MW | 3 343 | 2 386 | 252 | 948 | 100 | 9 | 22 | 0.66 | |

| IONITY | 218 MW | 1 089 | 1 089 | 340 | 0.58 | |||||

| Shell Recharge | 217 MW | 2 509 | 1 286 | 261 | 48 | 120 | 1 175 | 6 | 0.66 | |

| EWE Go | 212 MW | 2 689 | 1 493 | 205 | 167 | 58 | 1 029 | 22 | 0.44 | 0.44 |

| Allego | 182 MW | 2 055 | 1 284 | 198 | 356 | 55 | 415 | 28 | 0.61 | 0.48 |

| ChargePoint | 167 MW | 8 907 | 414 | 202 | 194 | 58 | 8 299 | 22 | 0.63 | 0.48 |

| Pfalzwerke | 149 MW | 1 883 | 993 | 216 | 206 | 54 | 684 | 20 | ||

| no operator name | 136 MW | 6 528 | 379 | 235 | 335 | 63 | 5 814 | 20 | ||

| Compleo | 120 MW | 7 864 | 133 | 258 | 107 | 72 | 7 624 | 21 | ||

| Citywatt GmbH | 94 MW | 1 116 | 478 | 289 | 27 | 52 | 611 | 22 | 0.79 | 0.54 |

| E.ON Drive | 75 MW | 3 197 | 270 | 208 | 507 | 56 | 2 420 | 18 | 0.60 | 0.49 |

| Mer Germany | 72 MW | 1 777 | 329 | 217 | 280 | 56 | 1 168 | 23 | ||

| Volkswagen Group | 70 MW | 5 600 | 106 | 198 | 176 | 53 | 5 318 | 17 | 0.70 | |

| reev | 61 MW | 4 309 | 28 | 239 | 90 | 56 | 4 191 | 21 | ||

| TEAG Mobil | 58 MW | 874 | 410 | 195 | 55 | 55 | 409 | 23 | 0.66 | 0.51 |

| ALDI SÜD | 55 MW | 1 612 | 373 | 150 | 210 | 58 | 1 029 | 23 | 0.33 | 0.24 |

| Comfortcharge | 48 MW | 1 195 | 422 | 152 | 156 | 53 | 617 | 12 | ||

| Lidl | 46 MW | 1 856 | 10 | 350 | 986 | 54 | 860 | 23 | ||

| Fastned | 45 MW | 255 | 231 | 311 | 24 | 50 | 0.58 | |||

| Vattenfall InCharge | 44 MW | 1 322 | 268 | 194 | 35 | 92 | 1 019 | 14 | ||

| EDEKA | 40 MW | 1 923 | 46 | 150 | 679 | 54 | 1 198 | 21 | ||

| Hamburger Energiewerke Mobil | 39 MW | 2 039 | 145 | 155 | 29 | 50 | 1 865 | 22 | 0.60 | 0.42 |

| GP Joule Connect GmbH | 37 MW | 786 | 173 | 268 | 51 | 79 | 562 | 20 | 0.76 | 0.56 |

| Porsche | 37 MW | 220 | 171 | 351 | 49 | 21 | ||||

| MENNEKES | 31 MW | 2 403 | 2 403 | 22 | 0.37 | |||||

| Wirelane | 31 MW | 2 847 | 11 | 50 | 2 836 | 19 | ||||

| JOLT Energy | 30 MW | 162 | 162 | 314 | 0.40 | |||||

| MVV Energie | 30 MW | 880 | 117 | 264 | 56 | 50 | 707 | 21 | ||

| Kaufland | 30 MW | 1 130 | 8 | 217 | 726 | 54 | 396 | 23 | 0.46 | 0.40 |

| ChargeIT mobility | 30 MW | 1 663 | 61 | 191 | 79 | 63 | 1 523 | 22 | ||

| Energie Südbayern (ESB) | 29 MW | 1 082 | 108 | 183 | 69 | 55 | 905 | 22 | ||

| TankE | 28 MW | 1 702 | 30 | 196 | 106 | 73 | 1 566 | 22 | ||

| TotalEnergies | 26 MW | 1 616 | 21 | 169 | 164 | 60 | 1 431 | 20 | 0.61 | 0.53 |

| Other brands | 1 329 MW | 71 479 | 3 321 | 210 | 2 940 | 58 | 65 218 | 21 | 0.64 | 0.54 |

| Grand total | 5 688 MW | 163 551 | 26 426 | 210 | 10 434 | 58 | 126 691 | 21 | 0.64 | 0.54 |

The prices shown are excluding VAT.

Future charging needs per region in Germany

The available power currently varies heavily per region.

Germany’s EV charging landscape is evolving fast, with increasing providers and available charging power, but there is still a lot of potential to create your ideal EV charging network.

However, the potential differs greatly between regions.

The German market is currently at 61% of the required power by 2030.

A few regions that stand out with a lot of developed capacity: Thüringen (86%), Niedersachsen (79%), Bayern (76%) and Rheinland-Pfalz (78%) are already closing in on their 2030 targets. But that still leaves opportunities for fine-tuning, upselling and ideal price-setting to boost ROI without overspending on unnecessary expansion.

On the other hand, some regions still show big potential to cover. Berlin (28%) and Nordrhein-Westfalen (47%) alone account for 1.527 MW out of 3.660 MW to develop by 2030.

For the Sachsen region, where the current needed capacity is at 52%, we have already identified a charging hotspot in Wilsdruff, one of many that you can identify in a few clicks with ChargePlanner.

In the next section, you can find the details of the charging needs per region and the current status of EV infrastructure in Germany.

Detailed overview of charging needs per region in Germany

| Zone (Bundesländer) |

Public charging power available in 2025 |

Public charging power needs 2030 |

Public charging power to develop by 2030 |

% public charging power available vs 2030 targets |

|---|---|---|---|---|

| Schleswig-Holstein | 218 MW | 308 MW | 90 MW | 71% |

| Hamburg | 119 MW | 278 MW | 159 MW | 43% |

| Niedersachsen | 632 MW | 802 MW | 171 MW | 79% |

| Bremen | 31 MW | 90 MW | 59 MW | 34% |

| Nordrhein-Westfalen | 1 071 MW | 2 263 MW | 1 192 MW | 47% |

| Hessen | 472 MW | 737 MW | 265 MW | 64% |

| Rheinland-Pfalz | 316 MW | 406 MW | 90 MW | 78% |

| Baden-Württemberg | 814 MW | 1 313 MW | 498 MW | 62% |

| Bayern | 1 101 MW | 1 450 MW | 349 MW | 76% |

| Saarland | 46 MW | 106 MW | 60 MW | 43% |

| Berlin | 129 MW | 464 MW | 335 MW | 28% |

| Brandenburg | 162 MW | 226 MW | 65 MW | 71% |

| Mecklenburg-Vorpommern | 93 MW | 135 MW | 43 MW | 68% |

| Sachsen | 200 MW | 385 MW | 185 MW | 52% |

| Sachsen-Anhalt | 124 MW | 198 MW | 75 MW | 62% |

| Thüringen | 161 MW | 187 MW | 26 MW | 86% |

| Total | 5 688 MW | 9 349 MW | 3 660 MW | 61% |

Needed power to develop between regions ranges from 26 MW to 1 192 MW

How can you create your most profitable network by 2030?

In the sprint towards the 2030 targets, making smart, data-driven location decisions is more critical than ever. Acting quickly is essential, but acting strategically is what drives real returns. True ROI comes from placing the right type and number of charging points at locations where connection costs are viable and demand is proven.

To do this effectively, you need clear insights into the factors that define the performance of EV charging stations: from car passage and dwell time to local activity and infrastructure access. But gathering, combining, and analyzing all that data? That’s a challenge.

That's where ChargePlanner comes in. The platform lets you simulate and test multiple configurations at once, combining best-in-class market data, local visitor behavior, and predictive AI.