France's EV Charging Market Report

Leveraging over a decade of expertise in location-based intelligence and predictive modeling, we have developed a comprehensive report on the French market for public electric vehicle charging, based on the curated data from the ChargePlanner platform.

.png?width=1000&height=1000&name=Market%20Report%20FR%20main%20visual%20(1).png)

Executive summary

France’s EV market is entering a new growth phase. The country is set to add millions of electric vehicles by 2030, but today’s charging network is not yet sized for what’s coming. Only part of the required capacity is in place, and infrastructure is unevenly developed across regions. At the same time, France’s low electricity prices help keep charging costs among the lowest in Europe, creating both opportunities and competitive pressure for CPOs.

Key insights of the French EV charging infrastructure:

- France’s EV fleet will grow from 2.56 million vehicles today to about 6.93 million by 2030.

- The numbers of chargers has to more than double to grow towards 7.8 GW of charging capacity by 2030.

- The market is concentrated: the top 10 CPOs control 52 percent of all installed charging power.

- The average charging price (~€0.42 per kWh for (ultra)fast) is among Europe’s lowest, linked to a substantial energy independence.

- Regional differences remain large, with BEV penetration ranging from 1.4% to 8.1%

- Renewed EV subsidies support continued adoption and will push demand higher in the coming years.

This report breaks down the status, competitive landscape and shows where opportunities in the French EV charging infrastructure lie.

Data sources: AFIR, Ministère de Transport, Ecomovement, INSEE

Table of Contents

EV charging market overview France vs Europe

France sits fifth in the European comparison. The country has a 3.75% BEV penetration rate, similar to Germany (3.7%), but still behind markets like the Netherlands (6.8%), the UK (4.27%), Luxembourg (7.72%) and Belgium (5.52%).

In Q4 2025, France has 167K public charging points, including:

- 133K AC chargers

- 13K fast chargers

- 21K ultrafast chargers

That’s a large network, but the share of ultrafast charging points is lower than in other countries such as Belgium, Luxembourg, or Germany.

The average DC charging point delivers 23.5 MWh per year, with a balanced ratio of EVs per charger: 19 EVs per AC charging point and about 120 to 190 EVs per fast or ultrafast charger, depending on location.

Fast and ultrafast charging in France sits around €0.42 per kWh, the lowest among the European countries in the comparison. This is due to the lower energy prices in France.

The prices shown are excluding VAT.

These numbers were reported on Q4 2025.

Evolution of EV adoption in France until 2030

France’s EV fleet is growing fast. The country has 2.6 million EVs today and is expected to reach 6.9 million by 2030. Most of this growth will come from battery-electric vehicles, supported by renewed national incentives.

This growth puts pressure on the charging network. France has about 4.7 GW of installed charging capacity today. To keep pace with demand, the country will need to expand toward 7.8 GW by 2030.

Many of the current chargers are underused or in the wrong places. Without targeted investment, this infrastructure gap will slow EV adoption, and limit the return on investment for CPOs. As the EV fleet grows, these gaps will become more visible.

Region differences in (B)EV Adoption in France

EV adoption varies strongly across France. Most regions fall between 2.0% and 4.0% BEV penetration, but several regions stand out on both ends of the spectrum - ranging roughly from 1.4% to 8.1%.

- Some regions already show high adoption, such as Paris (8.1%), Hauts-de-Seine (7.1%) and Yvelines (5.0%)

- The majority of France sit between 0% and 4.0%. These include: Loire-Atlantique (3.1%), Ille-et-Vilaine (3.0%) and Vendée (2.8%).

- Several low-density regions remain below 0%. Regions like Creuse (1.4%), Lozère (1.4%), and Haute-Marne (1.7%).

The map highlights a clear message: Growth opportunities differ by region, and so should investment strategies.

But there are still unserved locations. One such a location you can find in an automated hotspot report for France, generated by the ChargePlanner platform.

What is the EV charging capacity per brand in France?

10 brands hold around 52% of the market share

France’s charging landscape is competitive but increasingly shaped by a small group of operators. The top 10 CPOs control about 52% of all installed charging power, yet each follows a different strategy:

- Tesla, Electra, Ionity and Izivia primarily focus on (ultra)fast chargers, with Ionity having the highest average charging power, measured at 351 kW

- Powerdot and TotalEnergies even out their charging points with a balanced mix of Ultrafast, Fast and Slow charging points

- Engie, Freshmile and Carrefour put the most efforts into slow charging, with Freshmile almost uniquely investing in slow charging points

France's EV competitive benchmarking

Pricing reflects these strategic differences with price gaps between operators growing. Some networks aim for broader accessibility and set tariffs well below the national average, sometimes even €0.21/kWh lower:

- Ultrafast charging ranges from 0.21 up to 0.49 €/kWh, one of the lowest in Europe.

- Slow charging is more stable around and average of 0.34 €/kWh, with some exceptions.

This widening spread shows how operators are differentiating not only through network design but also through pricing strategy. It’s important to take the necessary actions with the growing price sensitivity of EV drivers.

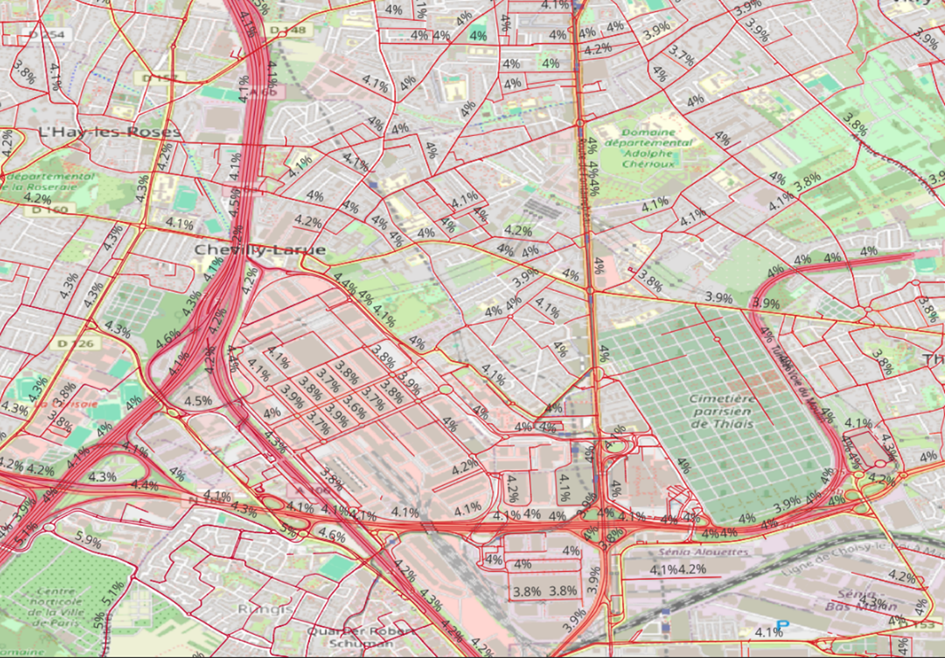

Local EV Penetration down to the Road Segment

France’s EV transition does not only differ by region or department. It also varies street by street. When looking at EV penetration at the road-segment level, clear patterns appear across cities and suburbs.

This level of detail helps operators understand where demand is forming in real time. It highlights where fast charging will soon be needed, where AC coverage can support daily routines, and where gaps remain in neighborhoods that appear similar at a larger scale.

How can you create your most profitable network by 2030?

In the sprint towards the 2030 targets, making smart, data-driven location decisions is more critical than ever. Acting quickly is essential, but acting strategically is what drives real returns. True ROI comes from placing the right type and number of charging points at locations where connection costs are viable and demand is proven.

To do this effectively, you need clear insights into the factors that define the performance of EV charging stations: from car passage and dwell time to local activity and infrastructure access. But gathering, combining, and analyzing all that data? That’s a challenge.

That's where ChargePlanner comes in. The platform lets you simulate and test multiple configurations at once, combining best-in-class market data, local visitor behavior, and predictive AI.